Energy as Catalyst

Oil Rig and Tanker, Ship Side View. Muchmania/AdobeStock

The new gas discoveries bring important investment opportunities to the region and the potential for nations to come together in the Eastern Mediterranean.

The Global Context

Consumption of liquefied natural gas (LNG) all over the world has been on an upward trend for several years and the surge in supply is expected to only increase in the future (by 45 percent between 2015 and 2021). New LNG projects are expected to add 175 billion cubic meters (bcm) to the market by 2020, coming mainly (90 percent of it) from Australia and the United States, an increase based on investment decisions taken before the gas price plunge. Increased supply can only bring the prices further down and the major exporters can only look towards smaller profits, as a significant cost would have to be added for liquefaction, transportation, and regasification.

A solution to maintaining higher margins and controlling variable costs is developing new gas fields in areas closer to the demand markets, which is why the new exploration contracts in the Eastern Mediterranean appeal to the world’s largest gas companies, such as BP, ExxonMobil, Statoil, ENI, Total, Qatar Petroleum, and Cairn.

Due to the proximity of large consumers such as Europe, Turkey, and Egypt, the planned output should be easier to contract from the start. It is clear however that a major collaborative effort needs to be undertaken by the countries in the region in order to fully benefit from the potential of the new discoveries and find the most cost-effective and efficient transportation methods.

The European Union (EU) is specifically looking to diversify gas supplies and integrate its markets in the aftermath of the Russian invasion of Crimea and the consequent straining of the relation with Russia.

The International Energy Agency forecasts that, by 2020, Europe and China will have the highest LNG import demand, with an increase by 70 bcm for Europe and by 90 bcm for China, with Asia’s total import needs estimated to reach 400 bcm by 2040.

Importantly, significant arguments for a continued rise in gas demand revolve around the environmental concerns. The United Nations Conference on climate change held in Paris in 2015 put forth a clear agenda for reducing the impact of fossil fuels on the environment, and LNG is the cleanest of all the other hydrocarbons. China’s example is the most telling, with natural gas demand doubling since 2010 in Beijing despite stagnation in electricity generation, which is in line with the government’s efforts to address the major pollution challenge.

The regional context

The regional context

Despite the projected growth, global LNG export infrastructure will not run at top capacity, which adds another component to any new investment decision. Two of such idle facilities are in Egypt. Companies developing new gas fields in the Eastern Mediterranean and buyers alike will consider all options available regionally, which is why political and economic cooperation is key.

Markets such as Turkey and the neighboring Greek islands emerge as the more obvious destinations for the gas produced in the region, both in terms of pricing – Turkey is purchasing gas with a minimum price of USD 10 per million British Thermal Units (mBTU), while average LNG prices fall below USD 7 per mBTU in Europe – and in terms of transportation options.

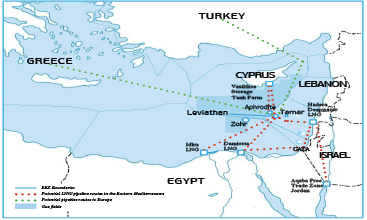

In the absence of pipelines, the need for LNG plants, floating LNG vessels and storage capacity becomes paramount. A couple of pipeline scenarios are currently being looked at, such as a pipeline connecting Israel and Cyprus to Greece – a common interest project according to the EU framework which refers to a special group of projects approved by the European Commission as eligible to receive funding for the study of their technical and financial feasibility – and a pipeline connecting Israel to Turkey.

Regardless of the chosen method of transportation, a single country investment in such major infrastructure projects is not easy to achieve in the region and not justified for anything less than a gigantic gas discovery, hence cooperating for a joint utilization of the LNG facilities in Egypt or the storage facilities in Cyprus is clearly an interesting proposition.

Most countries in the Eastern Mediterranean have understood the urgency to increase dialogue and work together to take advantage of the gas trade opportunities. Multiple trilateral cooperation talks, which culminated with summit events hailed as historic, have taken place over the past year, between Cyprus, Israel and Greece, and Egypt, Greece and Cyprus, respectively. They are expected to be the starting point of a larger regional association mechanism and a unification of commercial interests.

At this point, only Israel and Cyprus would become exporters, as Egypt’s discovery of a potential 845 bcm in the Zohr field, the largest ever gas find in the region, will be used to satisfy internal demand. The need for both Cyprus and Israel to become exporters is greater than that of Egypt, as internal demand is not high enough to justify the major investments needed to develop the fields. The ties between the two countries, traditionally peaceful and cordial, are currently further strengthened precisely by the export imperative for Israel, which has led it to thaw relations with Turkey. The latter could constitute a major market for the Israeli Leviathan (620 bcm) and Tamar (280 bcm) fields and the Cypriot Aphrodite (128 bcm) field.

A pipeline transporting gas to Turkey and perhaps further to Europe can only be constructed through the Cypriot exclusive economic zone (EEZ). Turkey is looking to diversify both its gas supply options and its energy mix. A combined production of Israel and Cyprus could potentially cover half of Turkey’s demand, which is a highly appealing option. However, in order for such developments to take place, a solution has to be found to the Cypriot problem, which is the expected outcome of the current talks between the Cypriot and Turkish communities, benefiting from momentum generated precisely by the commercial expectations surrounding gas.

VTT Vasiliko Limited, Oil and Gas Tank Farm, Vasiliko Terminal, Cyprus

Cyprus as a potential energy hub

As new models of flexible contractual structures will emerge, with buyers readjusting volumes, reselling surplus and using arbitrage to benefit from the best prices, Cyprus is uniquely positioned to become the regional gas trading hub, where buyers and sellers meet and establish their regional businesses, if such a market is both deregulated and incentivized by the local government.

Cyprus is the only EU member state in the region, benefiting from a sound legal framework as well as political and monetary stability. So far energy development in the area has been mired by a number of issues, from the political crisis in Lebanon, the deep economic troubles of Greece, and the restrictions imposed on Gaza by Israel, to the negative impact that both the regulatory challenges of Israel (which saw a firm agreement for the development and sale of gas with Noble/Delek being put on hold for two years and subjected to changes and popular scrutiny) and the inability of the Egyptian authorities to meet their payment obligations to LNG suppliers have had on the reputation of doing business in the region. Egypt is however expected to recover and it will bring gas to shore from its vast fields Zohr and the West Nile Delta (5,140 bcm) which will cover internal demand, allowing it to then resume exporting. Egypt can therefore share the role of a hub with Cyprus, due to its more developed infrastructure in terms of liquefaction capacities at the Damietta and Idku plants.

Such partnership can only be considered due to the excellent relations that Cyprus has cultivated throughout the years with its neighbors (aside from Turkey) and it is truly a testament to its diplomacy that has always been committed to achieving regional stability and a better communication for all the regional players. For the gas fields, there are already delimitations agreements in place with Lebanon, Israel and Egypt and a unitization framework agreement with Egypt.

Moreover, Cyprus can emerge as a knowledge-based economy for the oil and gas industry by creating a research and development, training and services cluster for the industry. Projects are under way to establish a regional network aimed at creating a set of rules for safety and environment protection, as it has become apparent to all the parties involved that a more stable region attracts bigger investments and healthier partnerships.

Cyprus has already been selected by a number of major oil and gas service providers as their operational hub in the Eastern Mediterranean. Major names such as Halliburton and Schlumberger have set up offices, but most notably the Dutch company Vitol chose to invest a whopping EUR 300 million in Cyprus after having examined all the other countries in the area. They found that Cyprus was strategically positioned for ships both entering and exiting the Suez Canal, it had a proper institutional framework to cater to their needs, highly trained, English speaking professionals, no security concerns and deep water proximity to shore. With little over one year in operation, the storage terminal is already running at its full capacity of 544,000 cubic meters of white products.

This type of infrastructure investment is crucial for Cyprus, as it does not only inject money into the economy, but it brings knowhow and technology in a market that still has a long way to go before becoming a household name for the energy business. However, the conditions are there and the current pro-market government is receptive and actively involved in catering to the needs of international investors, while recognizing their challenges and working to overcome them. In terms of positioning for the coming years, it is the ideal market for a company wishing to get involved in the early stages with patient capital and start reaping the benefits of a nascent oil and gas industry by the end of the decade.

By Ioana Belu

Related articles:

A Breath Of Fresh Air

Why Cyprus?

Fast And Glorious

OER: Business Intelligence Unit (BIU) supports free sharing and open educational resources. All the materials published on our website may be reproduced in any form for educational or non-profit purposes without special permission from BIU, provided acknowledgement of the source is made. For reproductions having a commercial purpose we welcome applications for permission consisting of a statement of purpose and the extent of the reproduction at info@businessintelunit.com